6 practical ways to help your employees financially this year

Blog

The cost of living crisis is still having an impact on many people as we head into the second part of the year. Here is a blog we released in January, with some top tips on how to help your employees financially for the rest of 2023.

As an HR department, you will want to support your employees through this difficult time. While pay rises seem an obvious answer, this isn’t feasible for every organisation.

Read on for six alternative and practical ways you could support your employees to help them manage through the cost of living crisis.

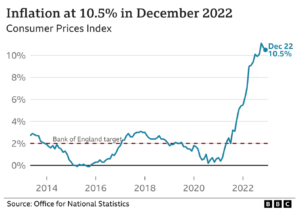

Inflation is currently at a 40-year high

In December the Consumer Price Index (CPI), one of the main measures of inflation in the UK, hit 10.5%. This means that, on average, something that cost £100 in December 2021 cost £110.50 in December 2022.

Food and energy prices are the biggest drivers of the price rise. This means that most people’s weekly grocery shop will likely be costing significantly more than it did a year ago.

While inflation has cooled from previous months, it’s still at its highest level for more than 40 years.

Source: BBC

It’s not just food and energy that people are having to cut back on

The BBC has reported concerning findings about the wide range of effects the cost of living crisis is having on people’s lives. Due to financial concerns, responses to their poll showed that:

- 78% of people are spending less on clothes for themselves

- 63% are putting off big purchases

- 66% were having fewer days out

- 53% are spending less on clothes for their children.

Also contained in the report was information from debt management charity StepChange, who suggested that money borrowed to pay for Christmas in 2022 could take some households years to pay off. They reported that 3 January 2023 was their busiest day for enquiries in over a year.

Aside from the headlines, Secondsight has also found evidence from our financial wellbeing surveys that more of our own clients’ employees are feeling more concerned about their finances.

Some people’s retirement savings could be affected by the crisis

According to figures from the Pensions Management Institute, 20% of pension savers have reduced or stopped their pension contributions over the past 12 months. What’s more, 20% are considering doing so in the coming months.

It’s clear that the cost of living crisis isn’t just affecting the weekly grocery shop. Without further help and support, some people could be affected by the crisis for many years and even into their own retirement.

You can help your employees to manage their finances

If your employees are experiencing some or all of these challenges, here are six practical things you can do as an employer to support your team and help them to improve their financial wellbeing.

- Run financial education sessions

Knowledge is power, so helping your employees to understand their own finances and the options available to them is one way that you can help them to take control of their financial future.

- Offer employee assistance programmes

If finances are starting to affect your employee’s wellbeing and performance, offering an employee assistance programme (EAP) could help them to overcome this. EAPs generally include access to experts on particular subjects and counselling to help them to manage the emotional impact of the problem.

- Enable employees to take a pension contribution holiday

If day-to-day expenses are starting to prove tricky to cover, employees might benefit from pausing their workplace pension contributions so that they can use the extra cash for their bills. However, stopping contributions could be detrimental to their financial future.

By offering a pension contribution holiday using the Secondsight’s Interim Income Accelerator you can continue to make your employer-matched contributions to the employee’s pension. There is also a process for ensuring that the individual has a plan for restarting their pension contributions when they are able to, so that their retirement savings continue to grow.

Get in touch to learn more about how the Interim Income Accelerator could help your business.

- Subscribe to an employee discount scheme

Allowing employees to get discounts at major retailers could help to cut their grocery bills and allow more people to have days or nights out by reducing the cost. This can make a big difference – not only to someone’s finances but also their overall wellbeing by allowing them to indulge in something that might currently be seen as a luxury.

If you already subscribe to a scheme like this, remind your staff what this gives them access to as they may not be aware of the range of discounts available. Secondsight also offer a cost-effective discount voucher marketplace to help employees to make big savings. Contact the team to discover how Mybenefitsatwork could benefit you and your people.

- Offer flexible working

Flexible working may not be an option for every organisation but think about whether you could offer slightly more flexibility than you perhaps do currently. For example, allowing employees to work slightly different hours could help them avoid travelling to work during expensive peak times.

If working from home is possible, giving employees the choice of where they work could be a great way to allow them to make a choice that is best for them. Perhaps working from home would allow them to save money on commuting costs. Or if they work from home a lot and are finding that their heating and energy costs are mounting up, working from the office might be preferable.

- Allow employees to claim expenses weekly rather than monthly

If employees are regularly spending their own money on travel or other goods and services for the business, allowing them to claim their expenses weekly could make a big difference for those who are struggling financially.

This will of course require co-operation with the finance department, but if it is possible, it could be a seemingly small but very welcome change.

Get in touch

If you want to work with a knowledgeable and friendly team that can advise you on the most suitable benefits, are easy to work with and want to help you engage with your people face-to-face, then we’d love to hear from you. Email info@second-sight.com or call us on 0330 332 7143.

Information correct as of 19/01/2023

Secondsight and MyBenefitsatwork are trading names of Foster Denovo Limited, which is authorised and regulated by the Financial Conduct Authority.

A pension is a long term investment. The fund level may fluctuate and can go down, which would have an impact on the level of pension benefits available.